Carl Richards is a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. The following article is reproduced with permission from his weekly newsletter and his website can be found here.

Greetings, Carl here.

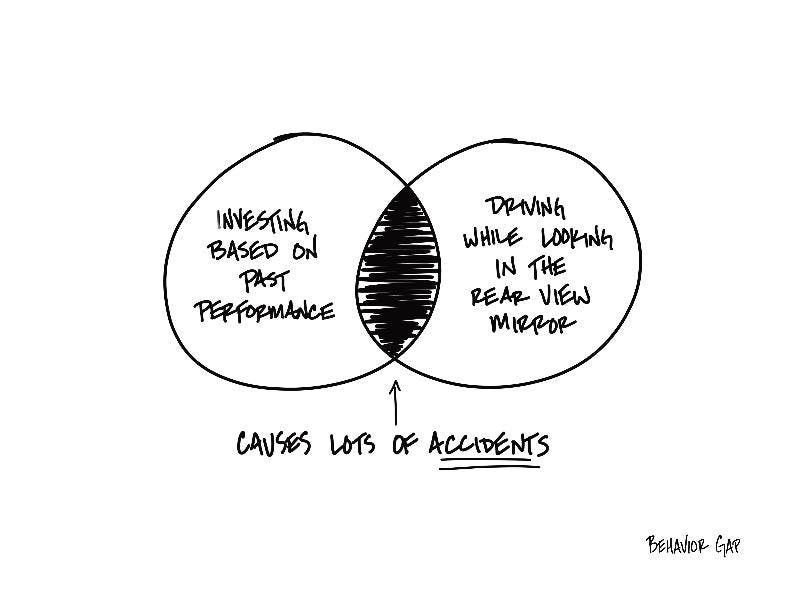

Investing based on past performance is like driving while looking in the rear view mirror. It. Will. Cause. Accidents.

Now, I know we’ve all heard the disclaimer repeated in every single investment advertisement: “Past performance is no indication of future results.”

We hear it often enough.

We might even believe it.

But then… what’s the first thing we do when we have a pool of money to invest?

In fact, what feels like the right thing to do?

No prizes for guessing because you know the answer. The first thing we do when we have money to invest is look for the investment that has recently done well. AKA, past performance.

Look, I get it. It feels like that makes sense.

If you’re going to hire a contractor to remodel your kitchen, it would be reasonable to go look at the work they’ve done in the past and to expect that quality of work to continue, if not improve.

But when it comes to investing, this does not hold up. Because investments go in cycles, looking at how things have done in the recent past leads us to buy high, which inevitably leads us to be disappointed, and then we sell low. And we repeat the process over and over and over.

Driving while looking in the rear view mirror doesn’t make sense. Neither does investing based on the past.

-Carl

P.S. As always, if you want to use this week’s sketch, you can buy it here.