Carl Richards is a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. The following article is reproduced with permission from his weekly newsletter and his website can be found here.

Greetings, Carl here.

Pretend for a minute that you find yourself in the enviable position of having chosen a few winning individual stocks.

You’ve made some money, and now you want to sell.

The question is: How do you know when it’s time?

There’s no one right answer to that question. But for starters, do yourself a favor and don’t confuse luck with genius. It’s really important that you’re honest with yourself. Did you make this decision based on lengthy research, or was this something a buddy mentioned to you on a bike ride?

With very few exceptions in my entire career, picking an individual stock and having it triple in price was a function of luck, not skill.

Second, review how these investments fit within the context of your financial life. Keeping an individual stock just because it went up does not qualify as a valid reason. That doesn’t take the larger context into account.

Next time you’re wondering if it’s time to sell, take a step back and do the following:

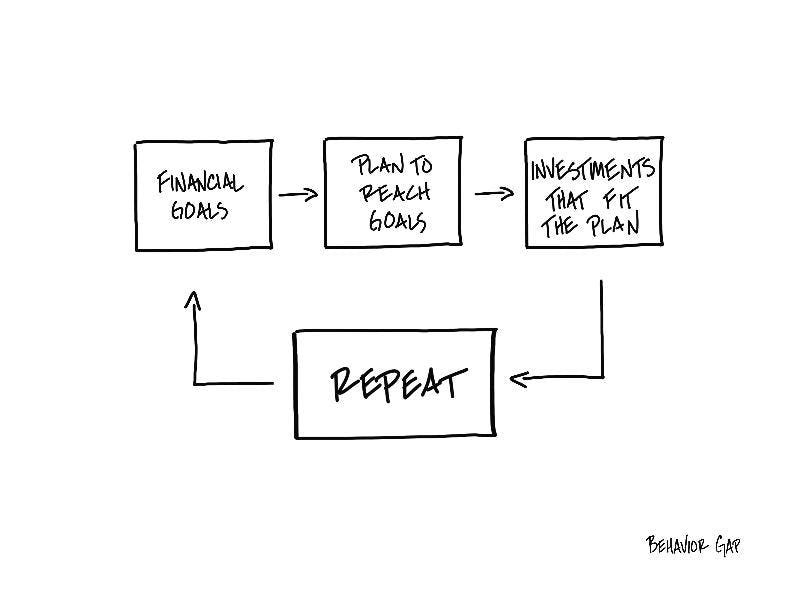

1- Clearly identify your financial goals.Get out a piece of paper, and write down what you want the future to look like. Don’t spend hours or days on this task. Give yourself some slack. It’s life, after all. Things will change, and it makes sense to revisit and redefine your goals periodically. But you have to start somewhere. These goals really are nothing more than educated guesses, but they’re at least a set of markers in the sand, something you can use as a reference point for your decision-making.

2- Make a plan to get there.Again, don’t spend too much time here because the variables that go into building a plan are nothing more than guesses. Still, the process is important. Using the information you have, estimate how much you can save for the next 36 months, make a guess at the rate of return you hope to earn, and carefully consider what risks you’re comfortable taking.

3- Decide if your current investments fit the plan.Maybe they do. Maybe they don’t. I don’t know. But if you look at your plan, you will.

4- If the investments don’t fit, sell!Now, you need to be prepared psychologically for what that means. I can promise you that if you make the decision to sell an investment, the stock will triple over the next couple of months after you sell. Vice versa, if you make the decision to hold an investment, of course, it will lose 20 percent of its value over the next three months. That’s just Murphy’s Law. That’s how this works. But as frustrating as that can be, you have to stick with the plan.

Making the decision to sell or hold an investment is relatively simple when we’re aware of the cognitive traps of fear and greed. It should be clear to anyone that if you own an investment that has tripled in price, and you made that investment based on luck, it would be wise to take some of the profit and go home.

Investment decisions like buying or holding are best made when you do so in the context of your financial goals. Picking the next Apple is not a financial goal. Saving for retirement or having enough money to send your kids to college are financial goals. Once we’re clear about the why, our goals, and we have a plan to get there, making investment decisions becomes much more simple.

-Carl

P.S. As always, if you want to use this week’s sketch, you can buy it here.