Carl Richards is a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. The following article is reproduced with permission from his weekly newsletter and his website can be found here.

Greetings, Carl here.

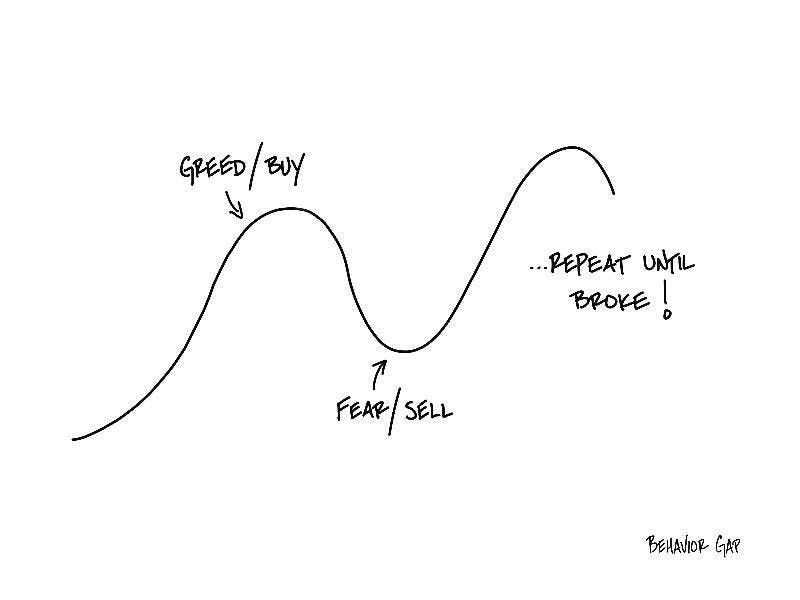

Most of us make the same mistake with our money over and over: We buy high out of greed and sell low out of fear, despite knowing on an intellectual level that it is a very bad idea.

The easiest way to see this behavior in action is to watch money flow in and out of mutual funds. Let’s go back to early 2000. The dot-com market had reached a fevered pitch. People were using their home equity to buy tech stocks right after the NASDAQ had a single-year return of better than 80 percent!

Then, in January 2000, investors put close to $44 billion dollars into stock mutual funds, according to the Investment Company Institute, shattering the previous one-month record of $28.5 billion. We all know the story from there. Money continued to pour into stock funds, breaking records for February and March and pushing the NASDAQ to 5,000, only to lose half of its value by October 2002.

This gets worse. That same October (at the low for the cycle), as investors were selling stocks as fast as they could, where was all the money going? Into bond funds, at a time when bond prices were near record highs.

Think about this pattern for a minute. At the top of the market, we can’t buy fast enough. About three years later, at the bottom, we can’t sell fast enough. And we repeat that over and over until we’re broke. No wonder most people are unsatisfied with their investing experience.

I realize this is a story from ancient history; 2000 feels like a long time ago. But we do this again and again. At this point, there’s a story like this every month.

Can you imagine doing this in any other setting? Picture walking into an Audi dealership and saying, “I need a new A6.” The salesperson says, “Oh my gosh, you’re in luck, we just marked them up 30%!” And you say, “Awesome, I’ll take three!”

Look, I get it. We’re hardwired to get more of what gives us security and pleasure and run away as fast as we can from things that cause us pain. That behavior has kept us alive as a species. Mix that with our desire to be in the herd, the feeling that there’s safety in numbers, and you get a pretty potent cocktail. When everyone else is buying, it feels like if we don’t join them, we’re going to get eaten by the financial version of a saber-toothed tiger.

But I’m telling you, this behavior is terrible for us when it comes to investing.

Of course, it’s important to know that it’s totally normal to feel fear and greed or to be scared when the markets are scary. The fact that you feel those things just means you’re human.

It’s okay to feel it. But understand that acting on it will cause financial harm.

So do whatever you need to do to not act on fear and greed. That could mean staying out of the kitchen, building guardrails, having a plan, or hiring an advisor. Whatever you need to do, just do it.

I have found that just knowing this helps me behave better. I hope that will also be true for you.

…

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.