Carl Richards is a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. The following article is reproduced with permission from his weekly newsletter and his website can be found here.

Greetings, Carl here.

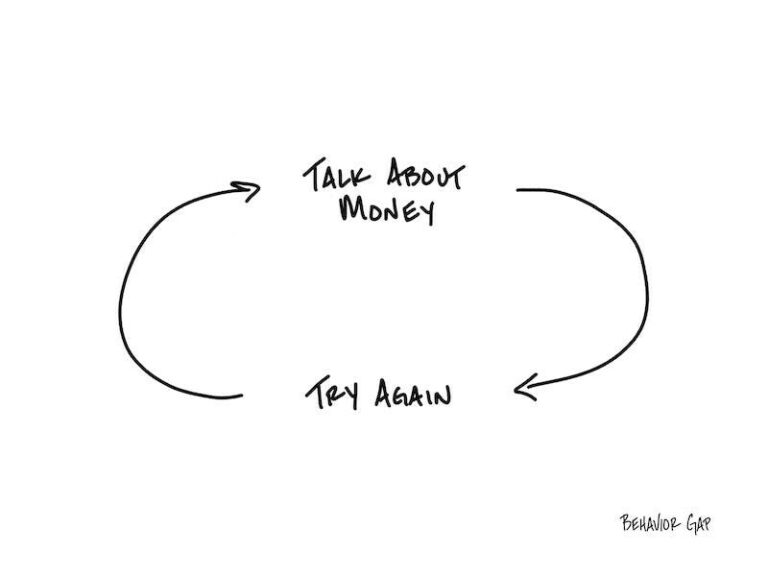

I’ve spent countless hours of my life talking with people all over the world about money.

During these conversations, one theme comes up again and again.

Anxiety.

Almost everybody has an idea of what the financial life of their dreams would look like.

Almost nobody has a plan for how to get there.

After having hundreds of conversations about this subject, I’ve come up with a strategy that may help.

But first, a couple of disclaimers:

1- It’s hard. Kind of like when your doctor tells you to eat more vegetables and exercise for at least an hour a day.

2- It’s boring. Like watching an oak tree grow. Think short-term boring, but long-term exciting.

For those of you I didn’t lose at hard and boring…

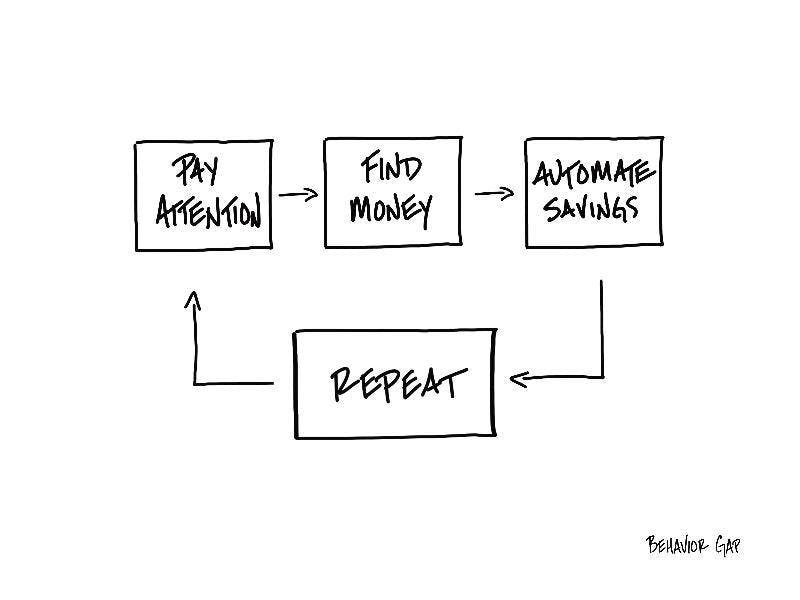

Allow me to present: Carl Richards’ Very Unexciting, Four-Step Plan to the Financial Life of Your Dreams!

Step 1: Pay attention to your spending.

Call it budgeting if you want, but I’m essentially talking about paying close attention as you spend money. This could be as simple as keeping an index card in your pocket and writing down every transaction or purposefully reviewing your monthly credit card statement. Whatever your method, just start noticing how you’re spending money.

Step 2: Find wasted money.

The hard part of saving isn’t saving itself. The hard part is finding the money to save. Not long ago, I figured out a routine that helped. I printed out my credit card statements and went through each charge. On one statement, a few lines down on the second page, I found a charge for GoGo internet service. That’s the internet service available while flying on many airlines. I recall the charge being $39 per month for unlimited access (now it’s $59 per month). After highlighting the charge, I leaned back in my chair, deep in thought. How long had it been since I last got online at 35,000 feet? In a moment of Zen-like clarity, I realized I hadn’t even been on a flight that month. I did the math and discovered it had been more than a year, 13 months to be exact, since I had used this service. For 13 months, I’d been paying for something I wasn’t using. I’d wasted more than $500. It’s crazy I let it go on for that long, but I’m glad I found it!

Step 3: Automate savings.

If anything qualifies as exciting, perhaps it’s this: I just found $39 per month to start saving. Because I was already spending that money, it wasn’t even going to hurt. All I had to do was log in (not at 35,000 feet) and set up an automatic investment for $39. Don’t get hung up on finding the best investment. That reeks of excitement, and we’re not into that. Just do something boring, like a Vanguard S&P 500 fund, or send the $39 to your kids’ 529 accounts. The important part is automating the behavior. Just have the money pulled regularly from your checking account and put into whatever boring saving or investment vehicle you decide. No stamps, envelopes, or willpower required.

Step 4: Repeat.

At the risk of making the plan sound fun, what if you decide to turn it into a game? Kind of like a treasure hunt! Every month, pull out your credit card statements and carefully take notice of every charge, look for wasted money, and add it to your automated savings. See how often you can move that number up. See if you can start a streak and raise the amount each month, even if it’s just $5 or $10. I know it may sound boring to save $39, then $50, followed by $65, or even $67 (those two bucks matter). But over time, those dollars add up. How high can the number go?

Some friends of mine played this game. They paid attention to their spending, found wasted money, automated their savings, and repeated their actions for longer than a decade.

When they started, they had a crazy goal of having $1 million dollars. I remember thinking that goal was crazy. They would need to do something exciting like find a hot IPO or invest in the best mutual fund ever to make that work.

Then, one day, I got a call. “Carl,” they told me, “we did it! We just crossed the $1 million mark.”

Yes, it took 10-plus years of consistently doing boring things, but they reached their goal.

And all it took them was doing four boring steps repeatedly for over a decade.

Hope that helps.

…

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.