Carl Richards is a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. The following article is reproduced with permission from his weekly newsletter and his website can be found here.

Greetings, Carl here.

There are a lot of people running around out there making a lot of noise and waving their hands, trying to tell you what you should be focusing on as an investor.

These “hand-wavey” people talk about China, things like the Fed, monetary policy, stimulus, asset allocation, cryptocurrency, and shiny objects like silver and gold. It’s an awful lot to keep track of.

And don’t get me wrong, some of those things actually do matter. It’s not a bad idea to learn about them.

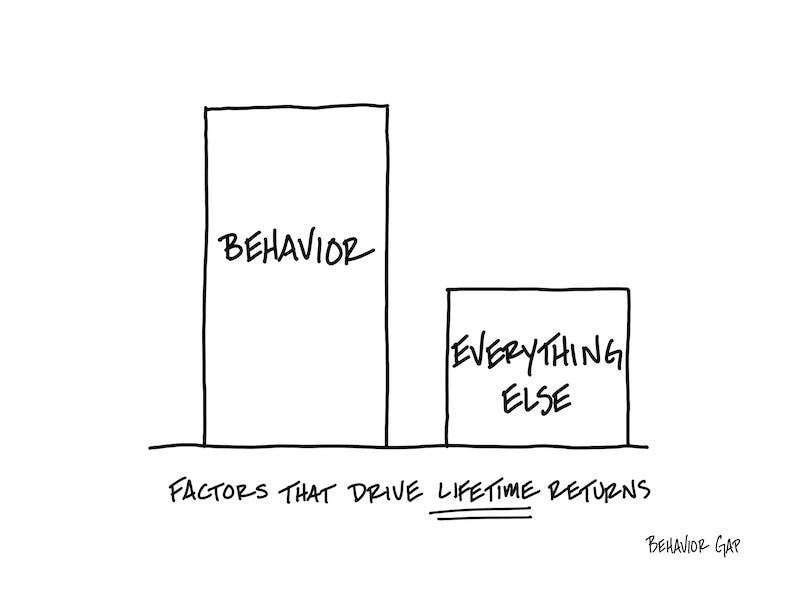

But one thing is certain: When it comes to investing, nothing matters anywhere near as much as your behavior.

You can design the greatest portfolio ever created by humankind, and one behavioral mistake a decade could mean you would’ve been better off in CDs at your bank or stuffing the cash in your mattress.

So yes, the economy matters, smart portfolio design matters, how much we have in small cap, value, and growth, all those things matter.

But the thing that matters most is having investments that will allow you to behave.

In fact, I would argue that even portfolio design only matters to the degree that it influences good behavior.

Arguing over whether you should have 17.2% or 17.5% in emerging markets might be an interesting debate, but the difference between 17.2 and 17.5 is a misdemeanor when the felony we’re all committing is behaving poorly.

So next time a “hand-wavey” person shows up in your face telling you all the things you should be doing, just smile, nod, and walk away.

And remember that none of it matters if you don’t know how to behave.

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.