Carl Richards is a Certified Financial Planner™ and creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. The following article is reproduced with permission from his weekly newsletter and his website can be found here.

Greetings, Carl here.

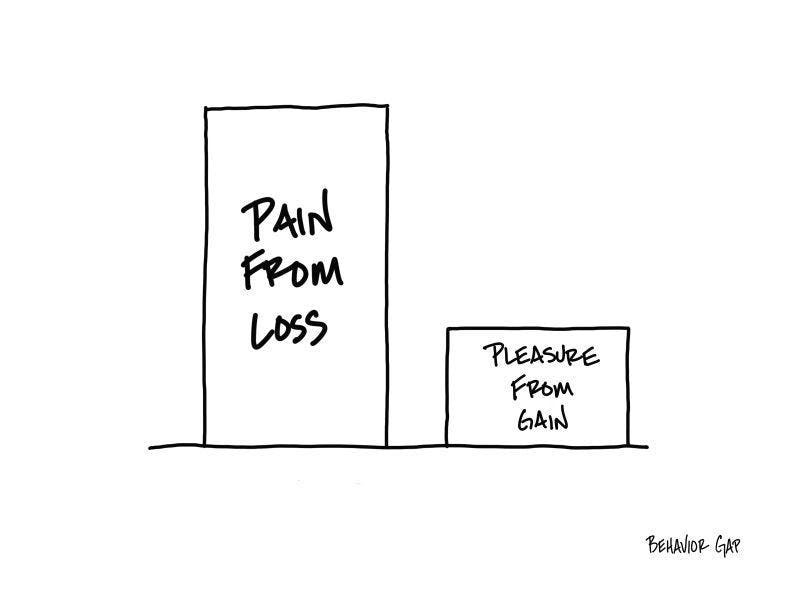

No one likes losing.

In fact, we’ll do almost anything to avoid it.

Academics even have a name for this. It’s called Loss Aversion. The reason we are so averse to losing is that we feel the pain of loss more acutely than we feel the pleasure of gain.

In other words, we might like to win, but we definitely hate to lose.

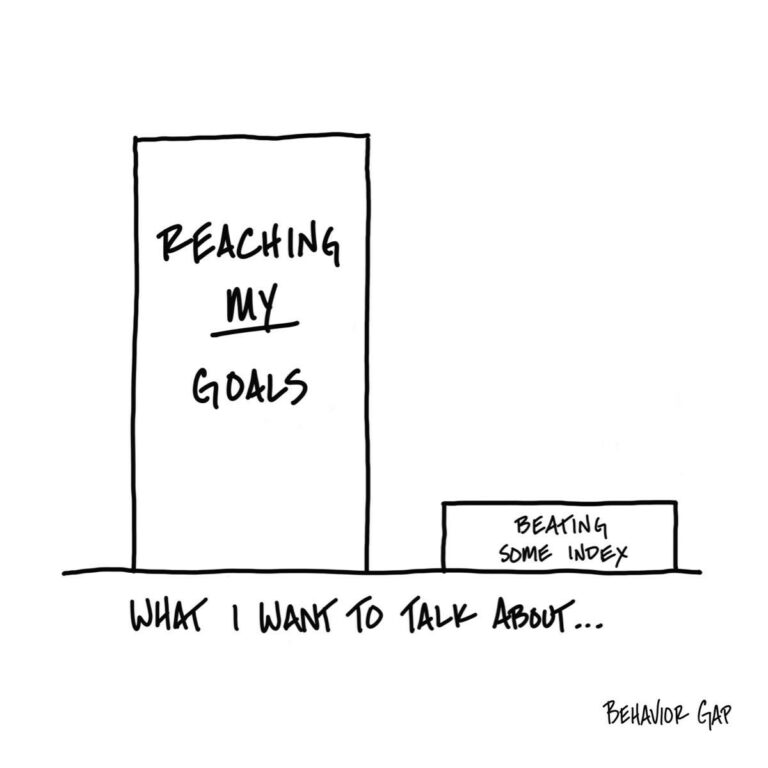

One place this shows up is in the process of building a financial plan based on your goals and values. For example, imagine that a few years ago, you hired an advisor and built a financial plan based on your values and goals. Now you have a portfolio of low-cost, diversified investments.

But you still have a dirty little secret: the stock your brother-in-law recommended years before that went down right after you bought it.

It clearly doesn’t fit in your plan.

Every rational thought, every spreadsheet, and every calculator tells you it’s past time to get rid of it.

But you don’t.

Why?

Because making the choice to sell would not only mean admitting you’ve made a mistake, it would also mean realizing a loss (and I’m not just talking from a tax perspective). And as we’ve discussed, we’re hardwired to go to great lengths to avoid that.

One trick I’ve found useful is called The Overnight Test. Here’s how it works.

Imagine you went to bed and, overnight, someone sold that brother-in-law stock and replaced it with cash. The next morning, you have a choice: you can buy it back for the same price or you can take that cash and add it to your well-designed portfolio. What would you do?

I’ll give you a hint: To date, no one has ever told me they would buy back the stock.

The Overnight Test is awesome because it changes your perspective from realizing a loss to (intelligently) investing cash.

It gives you the emotional distance and clarity necessary to make the right decision. And sometimes, that’s all it takes.

…

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.